tax strategies for high income earners australia

High income earners singles earning 90k and couples with a joint income of. Prepay tax-deductible expenses to bring your tax deduction forward.

Career As A Tax Return Accountant Skills Required Tax Return Accounting Tax Accountant

Superannuation contribution options to reduce taxes.

. A range of both basic and advanced tax strategies and investment options can be explored to this end. They borrow cash in exchange for fixed payments. Australians earning over 27k pay the Medicare Levy calculated at 2 of an individuals taxable income.

Effective tax planning with a qualified accountanttax specialist can help you to do. How Can A High Earner Reduce Taxable Income In Australia. Given that most are employed in.

According to the ATO youre classified as a higher income earner if you earn over 180000 a year. High-income earners should consider investing in municipal bonds. With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to.

Australias high-income earners can invest in family trusts. On the other hand tax-deductible contribution limits to a Solo 401k. Consider salary sacrificing to.

Structuring your business and personal assets. How to Reduce Taxable Income. The amount of offsets you get from your taxes Having a smaller.

Thats especially true if you earn more than 400000 as. Tax deductions you may want to maximize. 6 Tax Strategies for High Net Worth Individuals 1.

And things are about to get worse if President Biden gets his way. A donor-advised fund DAF is an investment account created to support. High-income earners will gain two-fifths of the Coalitions tax cuts in 2020-21 rising to more than four-fifths in 2021-22 according to the Australia Institute.

Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super. Reduce the income tax paid on dividends through franking.

Here are a couple of tax planning strategies that will be highly effective for you. Contact a Fidelity Advisor. If you are a high-income earner it is sensible to implement tax minimisation strategies.

In 2021 the employee pre-tax contribution limit. As a general overview the most beneficial strategies for tax minimisation are. Tax deductions are expenses.

Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. The maximum tax-deductible contribution for a traditional IRA in 2022 is 6000 if youre younger than age 50. Bonds mature with an initial return for the buyer.

Contact a Fidelity Advisor. A family trust or a discretionary trust can be a means for them to build wealth if they apply tax-effective financial. Appropriate types and amounts of insurance cover.

Investing in Early Stage Investment Companies. August 12 2014. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

The current top marginal tax rate in the US is 37. In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

Taking advantage of all of your allowable tax deductions and credits. Delay receiving income to avoid paying tax in the current financial year.

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

5 Top Benefits Of A Roth Ira Bankrate Roth Ira Old Man Cartoon Roth

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Think You Make Too Much To Use A Roth Ira Let Me Walk You Through The Backdoor This Step By Step Guide Will Walk You Through Roth Ira Ira Financial Literacy

Repost Entrepreneurs Lives Sales Skills Are Communication Skills Having And Developing Your Sal Sales Skills Business Ideas Entrepreneur Business Marketing

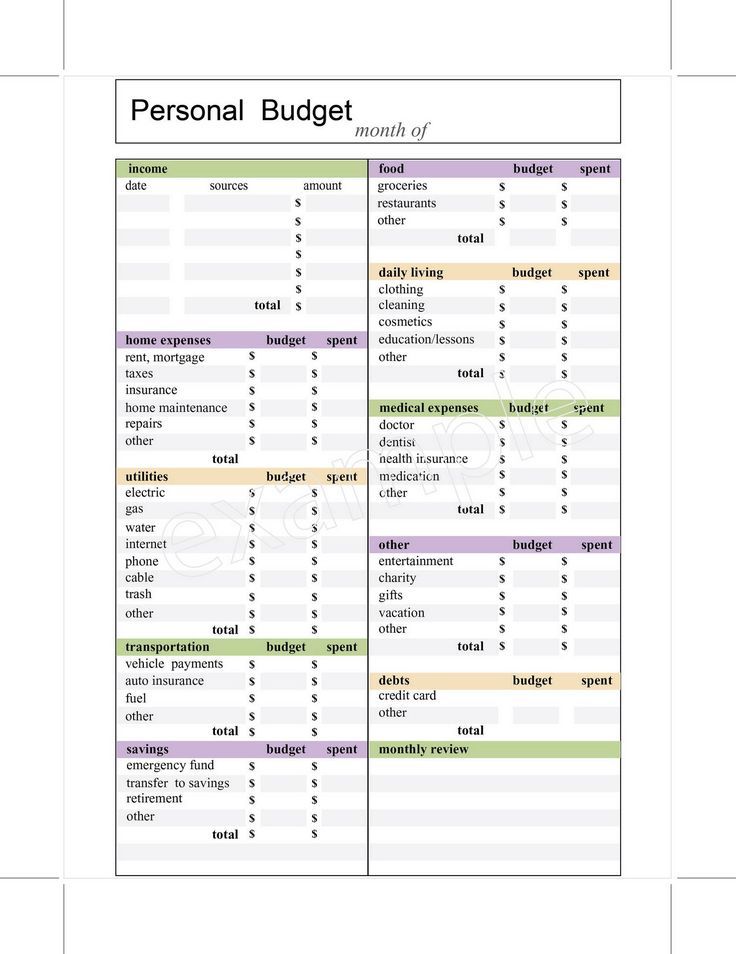

Monthly Budget Sheet2020 Budget Planner Budget Planner Etsy Canada Budget Planner Template Monthly Budget Planner Family Budget Planner

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Family Circus 4 15 10 Gif 320 367 Family Circus Family Guy Character

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Roth Ira Finance Wealth Building

4 Types Of Businesses Business Basics Business Marketing Plan Business Skills

Safemoneyhouston Blog Conservative Retirement Solutions Llc Tolerance Investing Insurance Industry

Money Focus On Instagram Why Most People Will Never Become Rich Tag A Friend Money Focus Investing How To Become Rich How To Get Rich

There Are Two Ways To Become A Millionaire The First Way Is To Find A Pr Business Inspiration Quotes Inspirational Quotes For Entrepreneurs Millionaire Ideas

Us States With The Highest And Lowest Per Capita State Income Taxes Map American History Timeline Mapping Software

Australian Income And Wealth Distribution Income Australian Australia Facts

How To Do Backdoor Roth Ira Roth Ira Roth Ira Contributions Finance